Press Release

Dataroid raises $6.6M to boost global expansion

Dataroid, an AI-powered digital analytics and customer engagement platform, has completed a US $6.6 M Pre-Series A investment round led by the FinAI Venture Capital Fund of Tacirler Asset Management. In addition to FinAI, the round also included participation from the Tacirler Asset Management Future Impact Venture Capital Fund and Endeavor Catalyst.

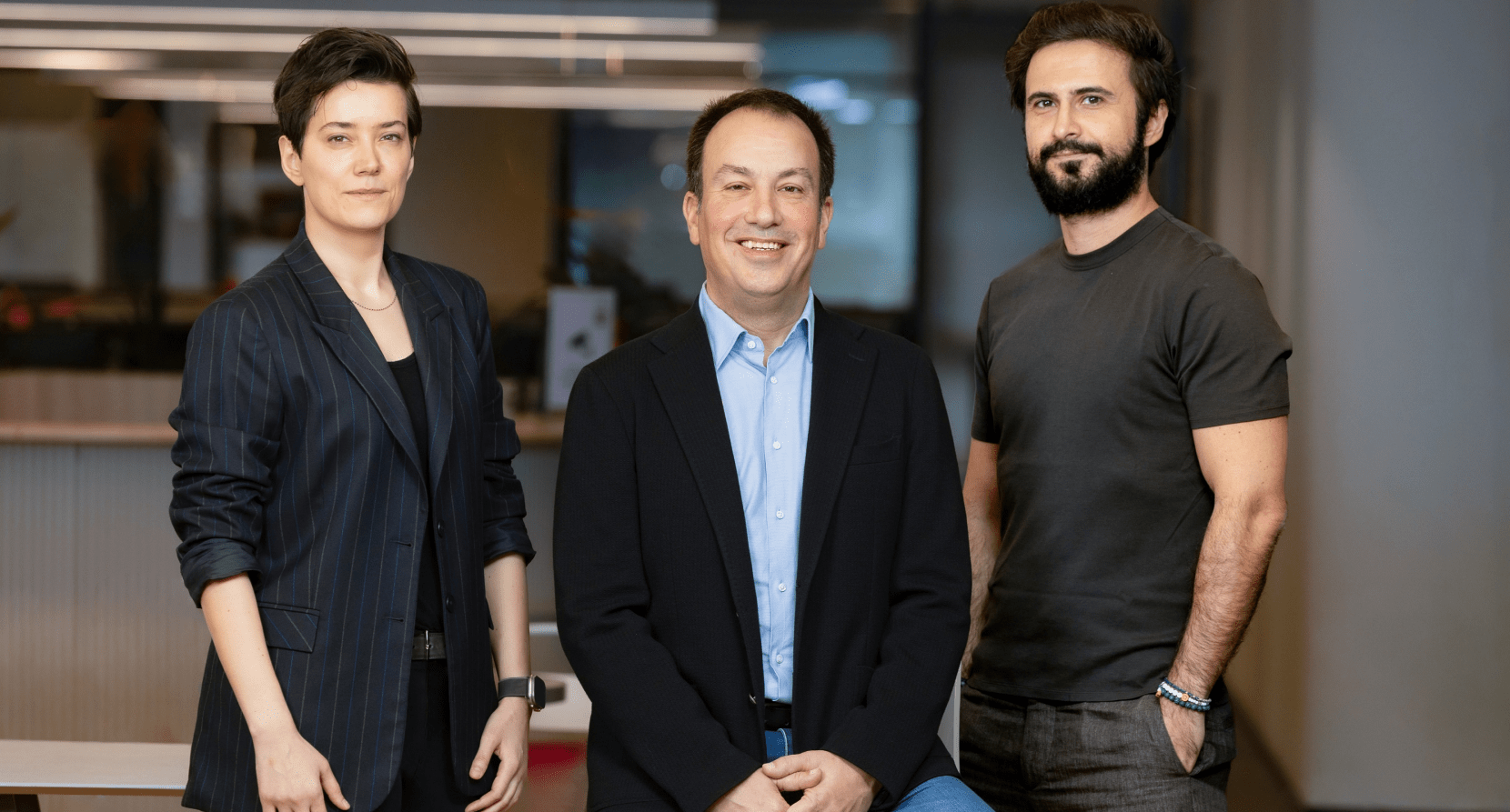

With the new investment, Dataroid, co-founded by Fatih Isbecer, Elif Parlak and Can Elmas, plans to expand its operational footprint across new geographies, particularly in EMEA, accelerate its global marketing efforts, and strengthen its self-service analytics capabilities through ongoing AI-powered product development initiatives.

Commenting on the investment, Özge Atalay, Co-Founder of FinAI Venture Capital Fund, said: “Dataroid’s technology stack, designed for highly regulated sectors such as finance and banking, has the potential to scale globally and become an industry standard in a short time frame. Having already proven its success across Turkey and the EMEA region, the company is now entering an international growth phase. As the first investment of FinAI, Dataroid represents a strategic and significant opportunity for us.”

Fatih İşbecer, Co-Founder of Dataroid, noted: “Working with banks in Turkey that reach tens of millions of digital customers gives Dataroid a strong foundation for global expansion. As the market-leading digital analytics platform for banking and financial services in Turkey, our platform today enhances the digital experience of more than 120 million users. We see expanding this value to new markets as a priority. With this new funding, we aim to strengthen Dataroid’s AI-focused capabilities in line with customer needs and accelerate our global marketing initiatives to bolster our presence in international markets, particularly across EMEA and Western Europe.”

According to reports published in 2025 by G2, one of the world’s largest B2B technology marketplaces, Dataroid was ranked as the number one digital analytics platform in the Middle East and secured first place in ‘Best Support’ under the product and customer journey analytics categories, based on customer feedback.

Dataroid closed 2025 with 127% net revenue retention and zero churn across both customers and revenue. The company had previously raised US $2 million in December 2023 from Koç Group’s Private Venture Capital Investment Fund and İşbank’s 100th Year Venture Capital fund.

About Dataroid

Dataroid is an AI-powered digital analytics and customer engagement platform that allows companies to measure customer interactions and experiences across different digital channels, enabling data-driven analysis and real-time action. Dataroid combines features such as enriched individual customer data, behavioral analytics, application performance management, and data modeling into a single platform, providing marketing, product, and technology teams with end-to-end customer insights. Dataroid platform is already used by medium to very large enterprises in financial services, airlines, and retail to reshape the experience of over 120 million users.

About Tacirler Asset Management

Established in 2012, Tacirler Asset Management is built on the Tacirler brand’s more than 30 years of capital markets experience. Operating with an active portfolio management approach, the firm manages approximately USD 1 billion in assets, and directly oversees thematic funds across alternative asset classes, including venture capital and private equity, in partnership with Turkey’s leading institutional partners.

Drive your digital growth

Schedule a demo today to learn more on how we can help you unleash the potential of digital using Dataroid.