Nays enhances digital channel experience and customer interaction using Dataroid

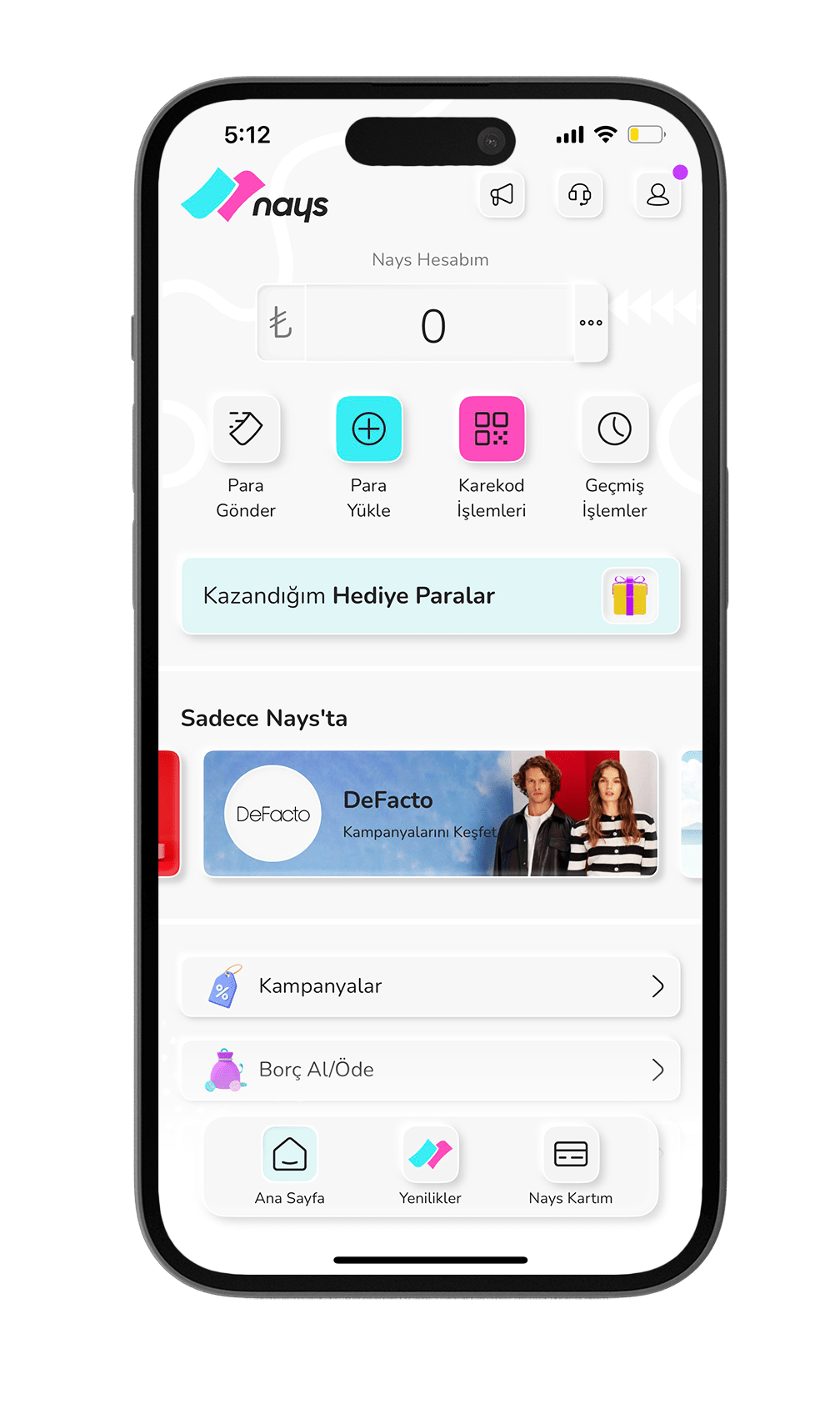

Nays is a multifunctional app offering significant earnings and micro-credit opportunities through discounts and gift money benefits on your purchases, including gamification. It also provides quick access to cash when needed and allows you to manage your daily financial transactions, including 24/7 money transfers. For the purpose of meeting changing customer needs and experiences, Nays started using the digital analysis and customer interaction platform Dataroid and thus achieved higher conversions with the power of data.

16.2%

401%

Challenge

Enhancing the First Money Transfer Experience

One of the challenges is to improve the user journey from account creation to the first money transfer in the financial sector. Achieving a successful first money transfer is vital for several reasons. It serves as a critical onboarding step, allowing users to become familiar with the app’s features and functionalities. It also offers them an opportunity to engage with users and maintain their interest in the platform. Furthermore, this initial transfer introduces users to the top-up process. Their overarching goal is to significantly increase the rate of first-time money transfers on the account creation date.

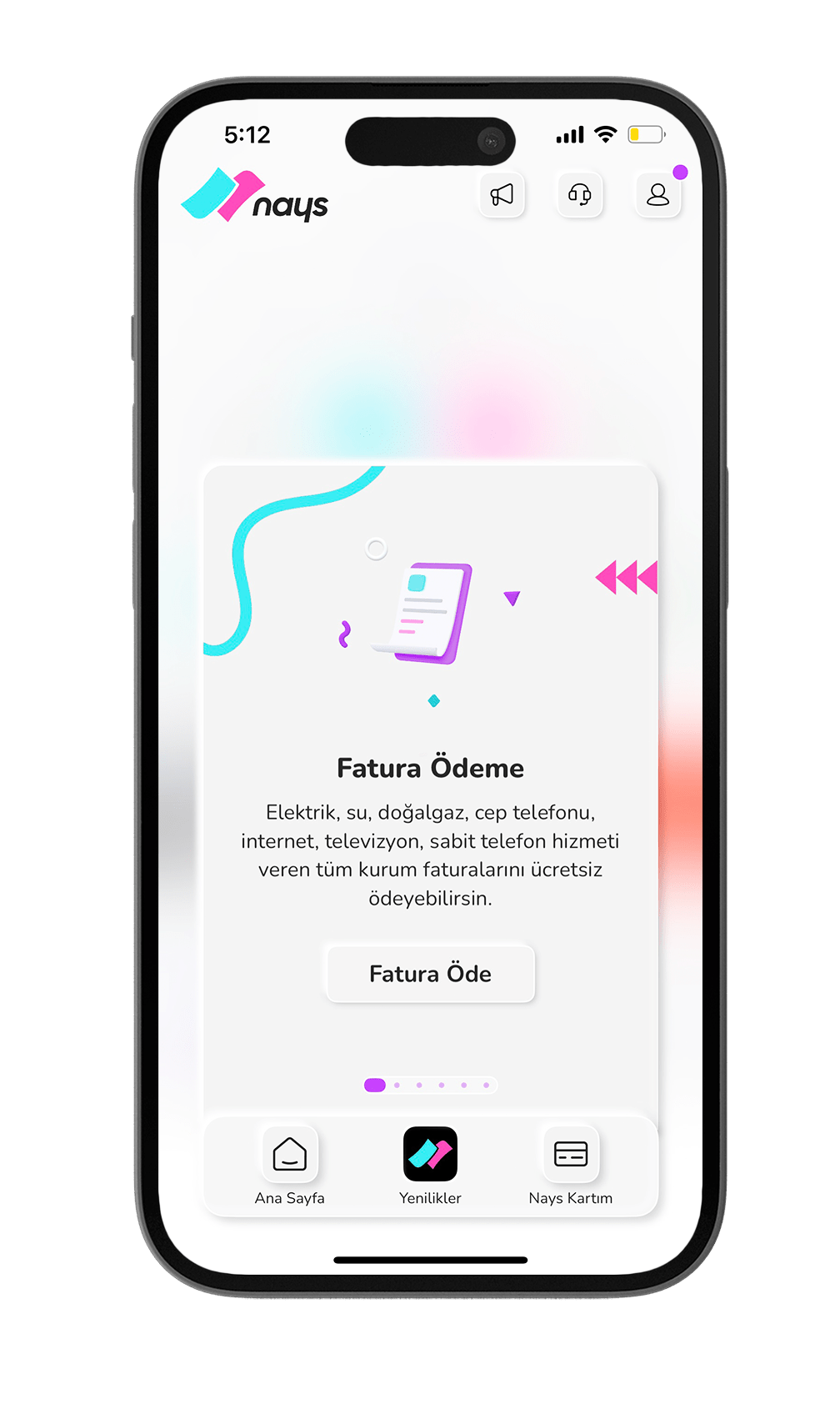

Reviving Interest in the Invite to App Feature

Nays’ “Invite to App” feature allows users to invite others to join the platform and earn rewards. Initially popular, usage of this feature declined over time. To address this, Nays used Dataroid to promote the “Invite and Earn” campaign to new users, encouraging early financial activity and boosting login rates. By offering the chance to earn up to 1000 TL for inviting up to 10 people, Nays aims to reignite interest and increase engagement with the feature.

Guiding Economy Shoppers Users Towards Utilizing the Micro Loan Function

Nays offers a micro loan function that allows verified users to access credit, recently expanding the limit to 20,000 TL. These users primarily focus on simple money top-ups, earning promotional rewards, and transferring funds to their bank accounts or other e-money applications. Nays faces the challenge of transitioning these customers to actively use the micro loan feature, ensuring they take advantage of the full range of financial services available. Nays aims to showcase how customers can succeed by using its digital analytics and customer engagement platform.

Dataroid has elevated our customer engagement strategies using real-time analytics and behavioral data. These insights help us tailor seamless digital experiences to user preferences. More than data analysis, Dataroid enables us to craft experiences that keep our DAU and MAU rates above 20%. We are dedicated to creating solutions that resonate on all digital platforms, surpassing user expectations.

Ceyda Yalçın

Solution

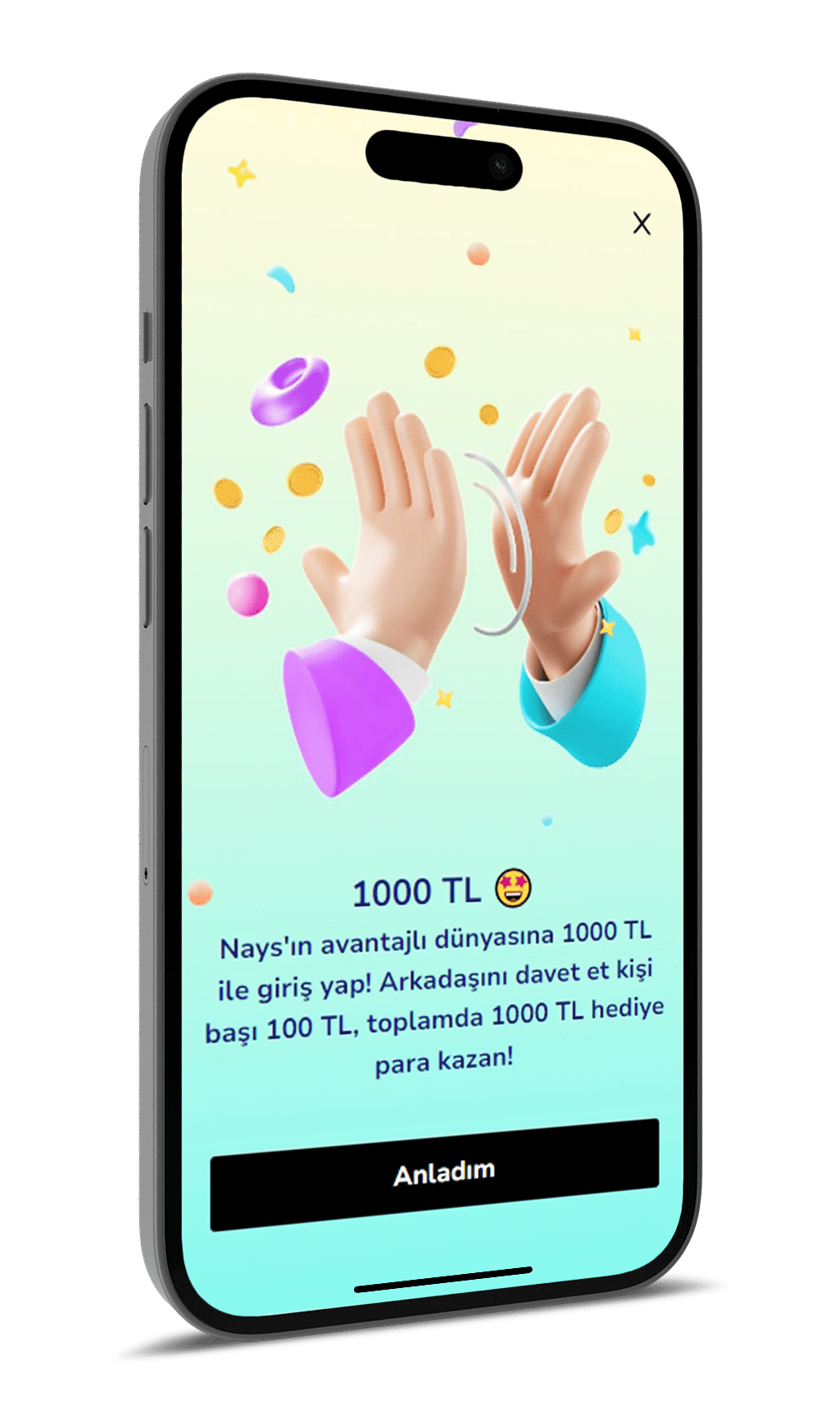

Raising the rate of first money transfer at the account creation date

The main goal of Nays was to increase the rate of initial money transfers during account creation. Analysis by Nays and Dataroid’s App Engagement showed that users who loaded money were more likely to become bank customers.

Using these insights, users were guided to make their first money transfer upon registration, speeding up their transition to bank customers (MOI). Dataroid’s advanced analytics on the second and third days supported the process, offering Win Now rewards. This approach, based on the App Engagement matrix, led to a 401% increase in MOI (Money Onboarding Initiative) initiations and a 329% rise in completion rates.

Improving user communication and increase the use of invite to app function

Nays’s invite function to the app allows users to invite their loved ones, colleagues, etc. One of the special features that allows them to invite. As a result of the App Engagement analysis made thanks to Dataroid, it was discovered that Nays’ daily push notifications were not sufficient, and people stopped using this function. For this reason, Dataroid’s Action Based Push feature was used to improve Nays’ communication with its users and increase the use of this function. After users successfully used the financial functions, push notifications were sent to invite them to the app function.

Directing users looking for promotions to get credit

Nays seeks to drive customer engagement beyond basic financial activities such as loading funds, earning rewards, and transferring money. To achieve this, Nays conducted a cohort analysis using Dataroid to optimize the utilization of initial credits offered to verified users. This analysis identified a segment of users, referred to as “promo-seekers,” who predominantly engaged with the “Win Now” feature. By leveraging Dataroid’s insights, Nays strategically targeted this group with push notifications and in-app messaging, effectively guiding them towards shopping activities. As a result, Nays tripled successful financial transactions, achieving a 3.43x increase through these focused campaigns.

Key results

The downward trend in first money transfers at account creation was reversed, with a 16.2% increase in the daily average

Nays surpassed its goals, achieving 6x its target with Dataroid's DEK onboarding and promotions, driving a 1000% increase in daily registrations

Dataroid-powered campaigns boosted MOI process initiations by 401%, with completion rates rising 329%

Nays boosted shopping activity through push notifications and in-app messages, resulting in a 3.43x increase in successful transactions

Drive your digital growth

Schedule a demo today to learn more on how we can help you unleash the potential of digital using Dataroid.