Garanti BBVA partnered with Dataroid to implement data-driven strategies that optimize customer interactions

Garanti BBVA is one of the leading global banks, known for its customer-centric approach and innovative digital banking solutions. With millions of customers across various banking segments, Garanti BBVA continuously seeks to improve user experience, reduce churn, and enhance customer engagement.

16M+

digital users

34.25%

9.44%

250+

Challenge

Real-Time Tracking of Customer Journeys to Deliver Timely and Relevant Communications

Understanding customer behavior across digital channels in real time is crucial for delivering a better experience and ensuring personalized, timely engagement. Garanti BBVA aimed to dynamically track user journeys and engage customers at the right moment based on their interactions, optimizing each touchpoint to enhance the digital experience for end users while driving higher retention and conversion rates.

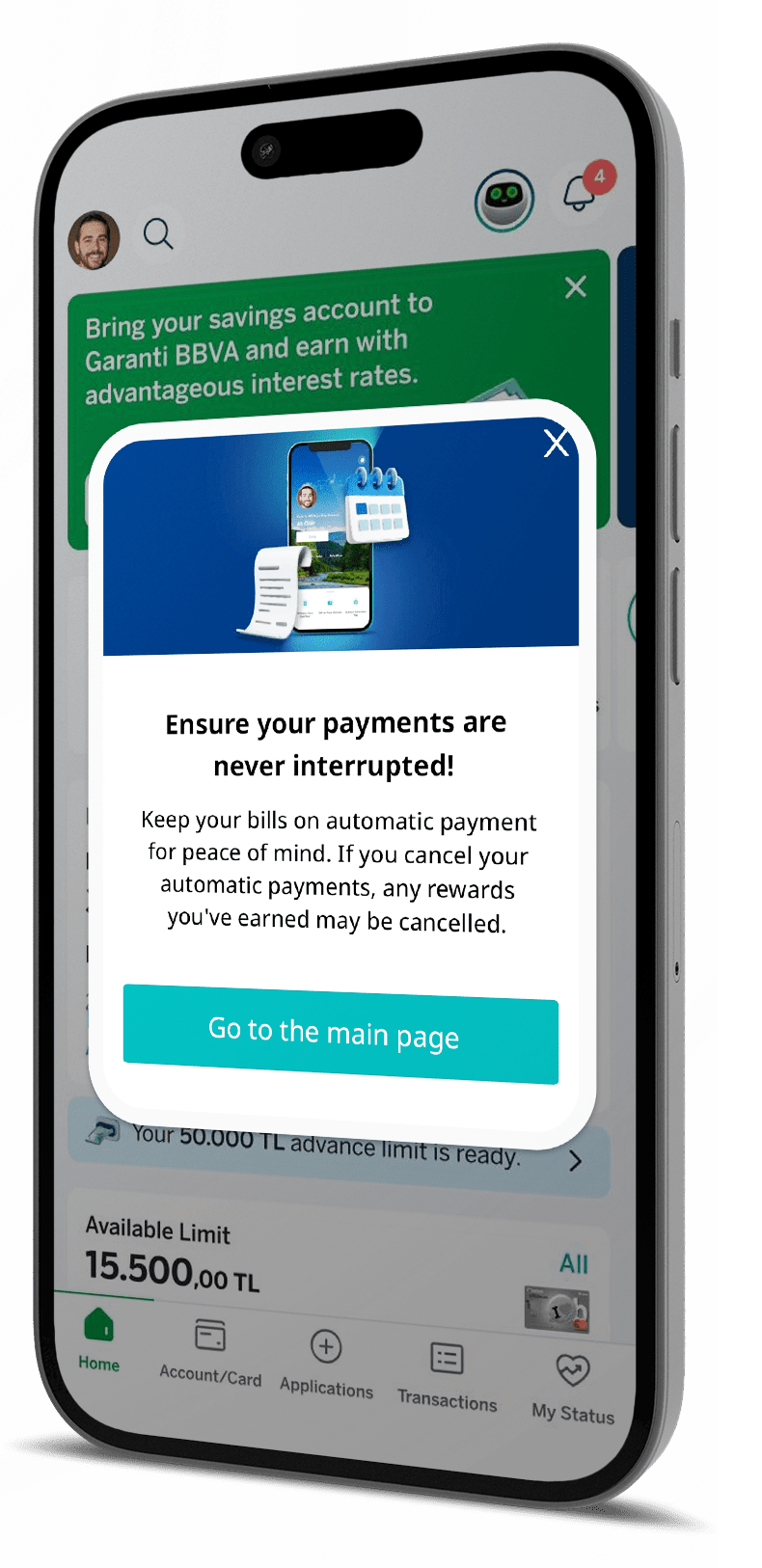

Encouraging Customers to Retain Recurring Bill Payments

Garanti BBVA customers were canceling their recurring bill payments, not always realizing how much convenience they offered. To enhance customer experience and make payments smoother, the bank aimed to encourage users to keep their recurring bill payments active, helping them save time and avoid potential hassles.

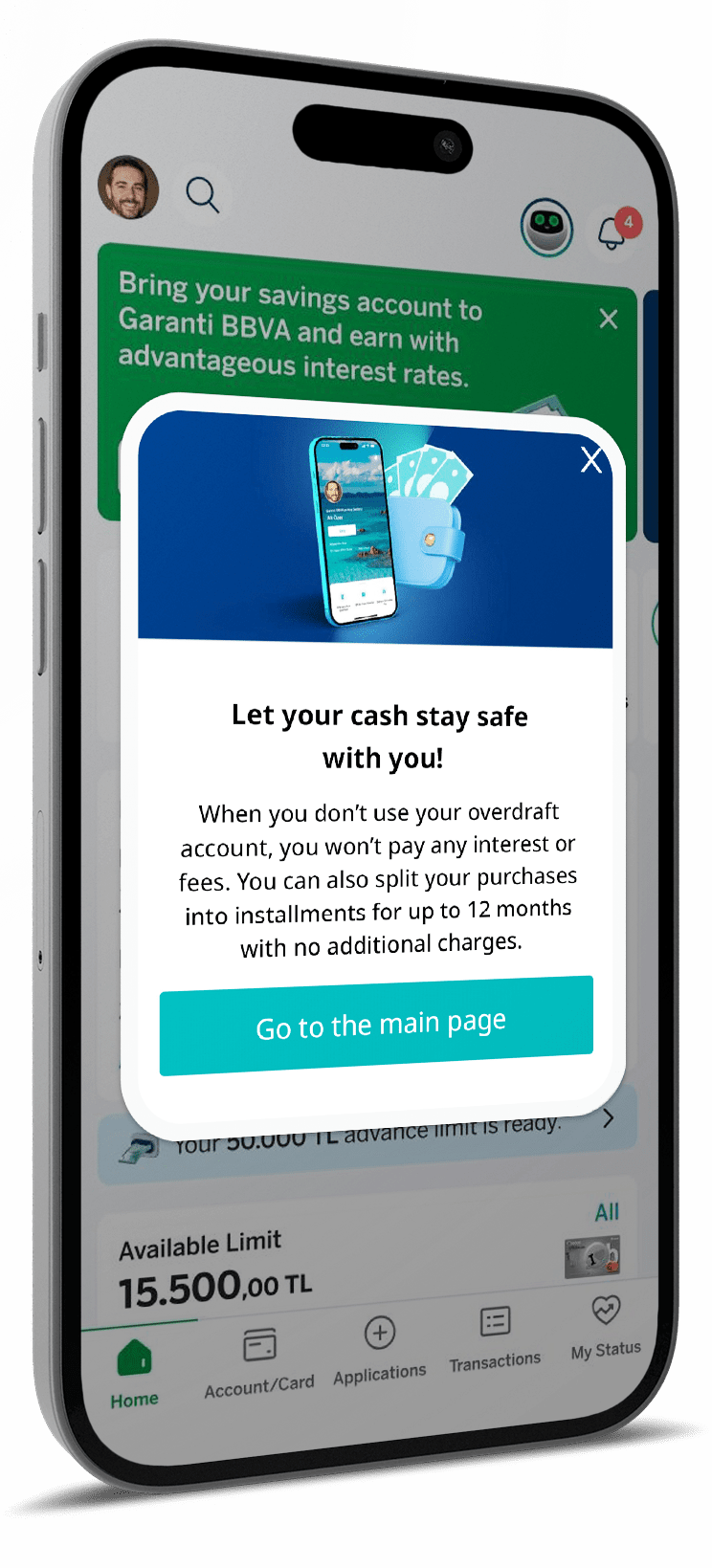

Helping Customers Maintain Their Overdraft Accounts

Garanti BBVA noticed that many customers were closing their overdraft accounts (KMH), unaware that they might be losing a valuable financial safety net. To help customers make informed decisions, the bank aimed to highlight the benefits of keeping their KMH open, such as flexibility in managing unexpected expenses.

Solution

To enhance customer retention and engagement, Garanti BBVA turned to Dataroid’s real-time analytics and in-app engagement capabilities. By leveraging data-driven insights and strategic customer interventions, the bank sought to optimize user experience, reduce churn, and improve overall satisfaction.

This collaboration with Dataroid underscores the importance of advanced analytics and personalized in-app experiences in banking, demonstrating their role in strengthening customer loyalty and driving deeper engagement.

Leveraging Advanced Analytics to Optimize Digital Journey Engagements

By utilizing Dataroid’s journey analytics capabilities, such as funnels, user paths, and retention cohort analyses, Garanti BBVA was able to identify key drop-off points and engagement opportunities within the digital journey. These insights enabled the bank to deploy targeted interventions based on real-time behavioral data, ensuring that customers received relevant and impactful messaging at the most effective moments.

Personalized In-App Messages to Retain Recurring Bill Payments

A Dataroid-powered in-app pop-up was introduced at the critical moment when customers initiated the cancellation process. The message highlighted the convenience of recurring payments and potential drawbacks of cancellation, such as losing reward benefits.

Targeted In-App Messages to Prevent Overdraft Account Closures

A similar in-app intervention was launched through Dataroid, where an in-app message was triggered when users attempted to close their overdraft accounts. The message emphasized the zero-cost maintenance and flexible installment options available for KMH users.

Key results

62.33%

of customers who saw the in-app message chose not to close their overdraft accounts

15.34%

of users who saw the in-app message decided to keep their recurring bill payments.

Deeper Understanding of Customer Journeys

By analyzing real-time digital user behavior with Dataroid, key drop-off points, allowing for more relevant and impactful customer interactions.

Optimized Engagement with Personalized Touchpoints

By delivering tailored in-app messages at key moments leading to increased satisfaction and stronger long-term engagement.

Drive your digital growth

Schedule a demo today to learn more on how we can help you unleash the potential of digital using Dataroid.