Reimagining Customer Engagement Strategies for Banking

- Reading Time: 8 minutes

Marketing strategies across industries are increasingly forced to deal with the digitalization of both their own field and the world at large. For some industries, using data and analytics to advance their industry comes naturally. Banking, however, is an industry whose complexity makes it difficult to reshape on the fly. The sheer amount of data and security issues as well make many banks – and many customers – wary of entry into the digital universe.

However, research has shown that data and artificial intelligence radically improve customer engagement in the banking sector. In this blog post, we’ll show you exactly why customer engagement is so important to banking and how banks can use data and the digital era to improve customer experience.

What is Customer Engagement?

Customer engagement is essentially the idea that increasing the interaction between customers and brands, particularly with personalized messages, increases brand loyalty. As a result, marketing strategies that focus on customer engagement help solidify long term relationships with existing customers as well as help create those relationships in new customers. In short, customer engagement is valuable for 3 reasons:

1) To bring new customers to a particular channel.

2) To onboard that customer, i.e. get them to the point where they become a regular customer after having first encountered your product or service.

3) Perhaps most importantly, for customer retention. To make sure that that customer remains with you for the long haul.

Sign up to drive your business with the power of data

Why Customer Engagement is Particularly Important to Banking?

Since the days of movies like It’s a Wonderful Life, the banking industry has relied on trust. What this means is that customer loyalty has always been critical to the industry, and now that the industry is changing it’s important to carry over that importance to new technologies.

Trust with a particular bank ensures that customers use that bank for all their banking needs, increasing revenue in the process. But it’s only by engaging the customer and showing them step by step that all of their banking/financial needs can be accomplished safely, securely and conveniently that customers will think about trusting the bank with their loyalty and their business.

Why are Traditional Customer Engagement Strategies not Working? Why do Banks Need to Change Their Customer Engagement Strategies?

We all live in the digital world these days, and the banking world is no different. For banks to sustain growth, it’s imperative that they update their customer loyalty strategies to be in line with the modern world. Part of this includes incorporating their marketing strategies and principles into the era of data analytics for a more personalized experience for their customers. Every step of the customer journey now needs to incorporate the digital world in order both to reach customers and also to give them the peace of mind required for them to do business with one particular bank.

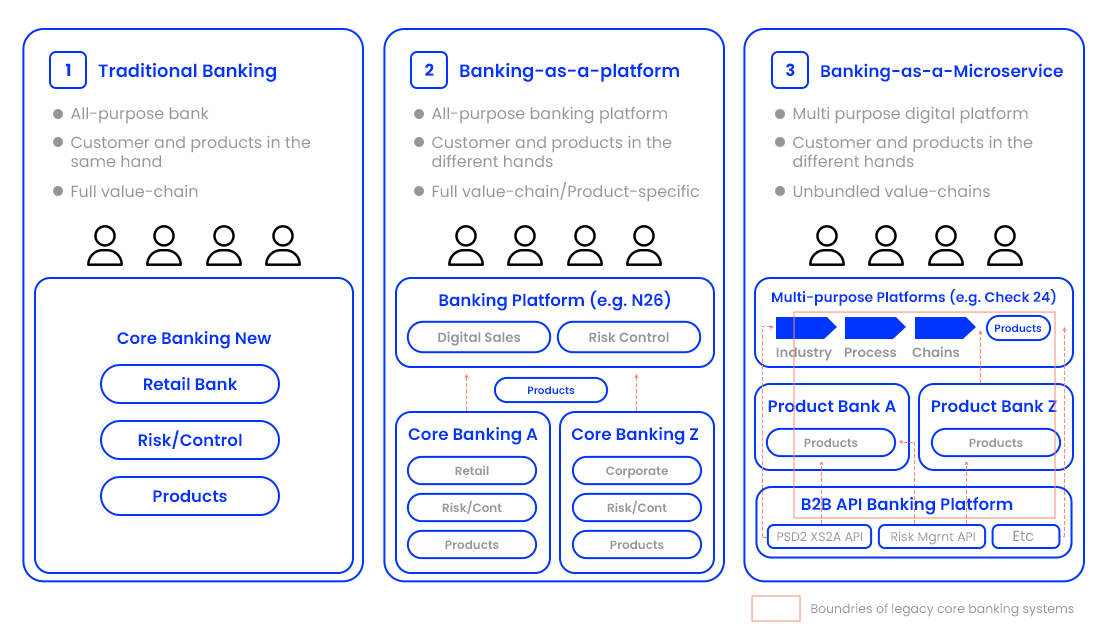

If banks remain in traditional banking paradigms, they’ll lose customers (as they already are) until they establish digital business models, including integrating themselves into digital platforms and improving the customer experience in the process.

But rather than fear change, banks should see this as an opportunity. Here’s how banks can use the digital world to engage customers:

1. Real-time Engagement

It’s obvious, but it still needs to be emphasized that one of the revolutions of digital engagement is that it provides for 2-way communication rather than 1-way. A traditional banking advertisement or billboard or something may tell the customer about their services, but in-app messaging offers genuine conversations that are simple and easy to use for the consumer.

This give and take offered by in-app messaging means that customers get information on the specific issues that are most important to them, and then personalized responses that speaks to their needs and to who they are, thanks to data collection tools that mean the bank can know their real-time behavior and form a detailed customer profile.

Dataroid is the kind of platform that has years of experience in exactly this kind of real-time behavioral targeting. Dataroid is great at using push and in-app messaging to maximize the customer experience for a contextualized and personalized experience. The way Dataroid works is to provide easier and more enjoyable communication (from the customer’s perspective) for digital users who want to receive cash flow information, get a loan, transfer money, or just about any other necessary service.

2. Chatbots

Chatbots are another popular way that banks are attempting to engage with their customers. Conversations with bots can be recorded, which in turn builds data and can help future decision making. Chatbots can be used on phones, laptops, or even as standalone kiosks in physical bank offices.

As with other technologies, chatbots must be constantly monitored to make sure that they’re designed and streamlined with a bank’s messaging, and analytics collected both from the chatbot itself and also from other sources can be extremely helpful to making sure it’s constantly updated and developed properly.

3. Optimizing Websites and Online Portals

Now one of the primary ways that people interact with their banks is through websites and online portals. Making those as seamless and easy-to-use as possible is critical to creating the seamless experience that customers seek when they use a bank. Around 70% of customers use online portals and websites regularly for their banking, so it stands to reason that if these aren’t perfectly streamlined, then the user’s experience of the bank as a whole will suffer tremendously.

These websites need to be optimized both for user experience and in tandem with that, streamlined to data collection. What pages are most visited, what prompts lead to further visits and higher degrees of customer satisfaction, and so on. Then that data, when put to good use, can improve the customer experience even further as everything gets optimized in a virtuous circle.

On top of that, these present an opportunity to produce customer surveys, which are an excellent way to accumulate data that to use to further refine the customer experience across portals by personalizing and prioritizing customers’ needs.

4. Make Sure Everything is Available on Mobile

The great advantage of mobile apps and making all your financial services available through mobile is that all of that is data you can use to optimize services and optimize customer engagement. Now, approximately 76% of people already use their bank’s app and one can safely assume that that number will only rise. A powerful banking app is absolutely essential to making sure that customers can reach a bank whenever they want and interact with that bank for all the services they require.

During the COVID-19 pandemic, we all had to rely heavily on remote banking. Now, even as the pandemic has waned, the trend towards remote banking is set to continue. Habits have shifted, and the ability to manage all banking needs from a mobile device has become more crucial than ever. In a more globalized world, customers often bank from countries where their bank might not have a physical presence. Additionally, the general shift towards remote business has made seamless digital banking a necessity.

But like we said, once you’ve established a seamless mobile app, then you’ve the opportunity to use the data you acquire to use data-driven insights to improve your marketing strategy and further engage your customers. For instance, it’s easy to collate exactly what behaviors are most popular on an app, and you can then reward those behaviors further and increase customer loyalty. This in turn drives growth, and fuels further customer interaction in a virtuous circle as engagement furthers growth and growth furthers engagement.

Another thing that apps are helpful with is giving advice to problems that arise. For example, someone who wants to be a digital customer, even though he/she is already a customer of the bank, gets an error. At this point, the app can remind the clients that they’re already clients and redirect them to login. Or, when the user who wants to make a limit change gets a meaningless error, the app can direct the user to click on the call center.

The Dataroid platform excels at creating frictionless campaigns using data-driven insights to enhance the quality of interactions with a bank’s customers. Growth requires high levels of personalization and targeted product offerings, all of which come with improved data analysis. Dataroid helps identify the most common or likely pain points and technical issues, as well as the probability of a user’s interactions leading to errors. From there, it can recommend corrective actions, often before the potential pain point is even reached.

This experience improvement is not just about solving issues but also about driving revenue growth. By integrating these insights with targeted campaigns, banks can increase customer satisfaction and engagement, which in turn boosts revenue. The ability to personalize offers and communication based on real-time data ensures that customers receive relevant and timely information, enhancing their overall experience and loyalty to the bank.

5. Taking Advantage of Non-Bank Innovators

In line with the previous point about data, the digital world offers the opportunity to form partnerships and relationships with the digital ecosystem and big tech companies to acquire even more data and personalize the customer experience even more.

WeChat, as one example, already has over 600 million users who can pay directly through their chat window. Google, Facebook, Apple and other tech giants are obviously companies with which almost every human being already has a relationship of some sort. When banks partner with these companies, it helps fuel trust by associating the bank with a brand they already know. It also helps streamline the user experience by making it more intuitive, and also helps create new ways to manage money with financial analysis.

Key Takeaways

The banking world is changing, and those that don’t will get left behind. The modern consumer is on a million different channels for a total omnichannel experience, and it’s critical for banks to optimize this customer experiences across those channels and engage with them to generate brand loyalty and growth. Branchless banking is the way of the future, with predictions that up to 40% of banks will be completely branchless within a few short years. Banks that don’t embrace the digital world are set to lose customers as they lose a CX that increasingly is global, where customers from all over the world can meet digitally when in-person meeting is impossible. Banks that don’t embrace the future are in a UX increasingly divorced from how users live their lives – on their phones and their devices – in favor of a world where everything can only be done in person. Retention rates for such customers will crash year on year as every industry, including banking, digitalizes and optimizes in sync. Banks must be able to provide all services digitally, and streamlined across every channel their users might find them on.

There are a number of ways to do this. It’s important that brands find ways to analyze huge amounts of data to personalize the experience for their consumers. This can be done through in-app messaging, chatbots, websites, or other forms of online portals. All of their information needs to be streamlined and easy to use across mobile and physical locations, including when even non-bank innovators and big tech companies are used in partnerships. Once the data is collated, engaging with customers in a 2-way, personal relationship is genuinely possible on a huge scale – ensuring that the successful bank becomes the primary bank for literally hundreds of millions of users.

YOU MAY ALSO LIKE

User Path Analysis: How to Understand and Improve Your Customer Journey

What is User Segmentation? A Complete Guide to Targeting Your Audience

Top 6 Strategies for Increasing Customer Loyalty

How to Perform Customer Behavioral Segmentation in 5 Steps

The Importance of Event Tracking in Banking

Drive your digital growth

Schedule a demo today to learn more on how we can help you unleash the potential of digital using Dataroid.