Tami Partnered with Dataroid to Optimize In-App Customer Acquisition

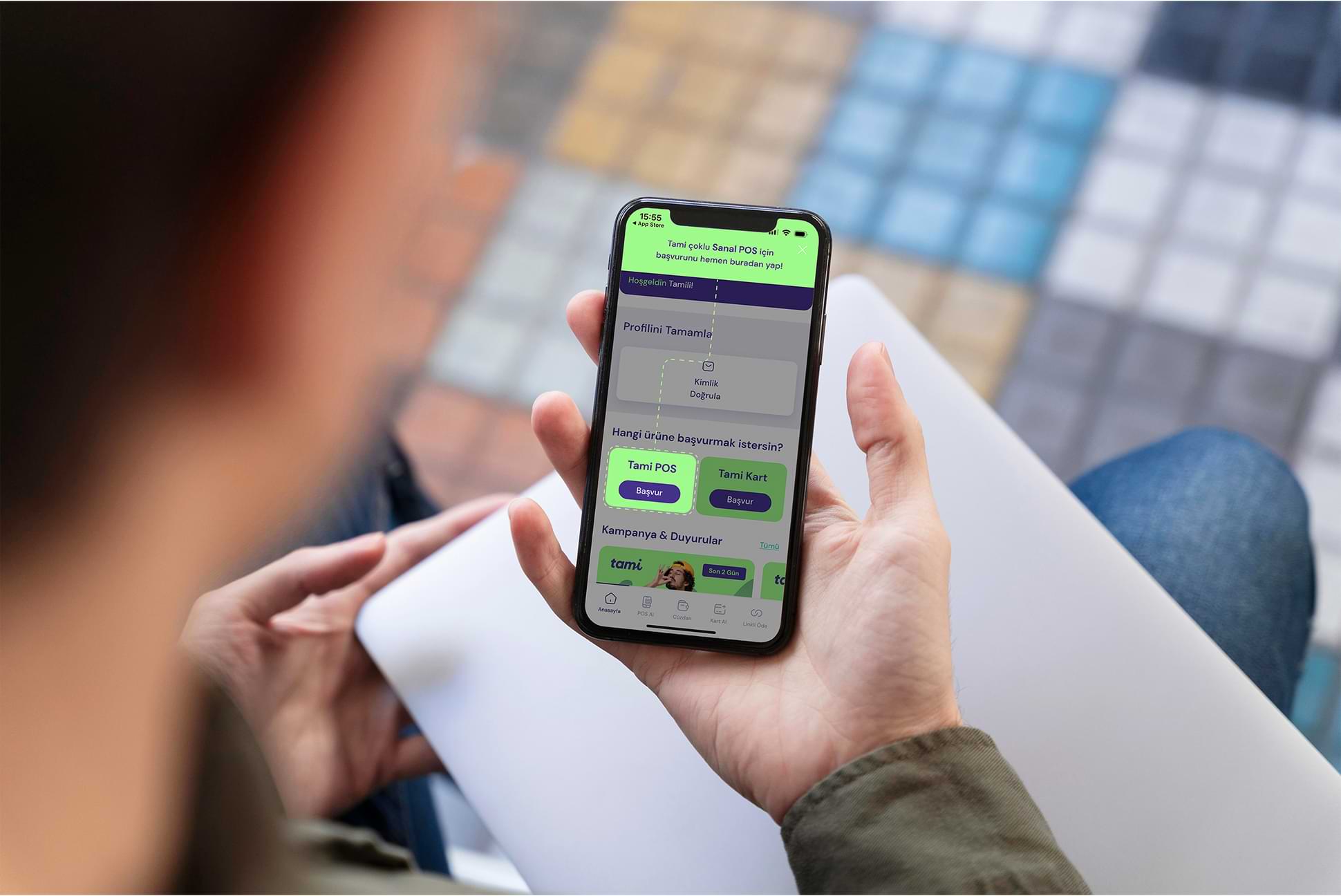

Tami, a Garanti BBVA brand, serves individual consumers and businesses with POS solutions and card products through a digital-first model. Tami partnered with Dataroid to enhance customer acquisition funnels in its mobile app and increase conversion. Through this collaboration, Tami achieved up to a 130% increase in conversion rates.

130%

Challenge

Identifying Leakage and Optimization Opportunities in Customer Acquisition Funnels

Tami’s business model serves both individual consumers and businesses. After downloading the mobile app and signing in, each Tami customer must complete a structured, KYC verification process and POS/card application before being recognized as an active customer. Tami aimed to gain a deeper understanding of these funnels, identify opportunities for optimization, and ultimately enhance customer acquisition rates.

Turning Drop-Offs into Active Customers with Real-Time Engagement

Tami needed an effective way to re-engage users who abandoned the KYC verification and POS application processes and encourage them to complete their journey toward becoming active customers. The company recognized that these users represented a significant opportunity, individuals who had already shown intent but failed to convert due to friction points, lack of clarity, or timing issues.

Solution

Increasing Conversion from Registered to Active Customers with Behavioral Analytics

Tami leveraged funnel analytics to gain a clear understanding of user drop-offs throughout the KYC verification and POS application processes following account creation. By analyzing user paths, Tami explored how users navigated within the mobile app after dropping off from these steps. Through these analyses, Tami uncovered key behaviors and pain points that contributed to funnel leakage.

In parallel, Tami conducted retention analyses to measure the rate of POS applications within the first three days after account creation and login. These insights highlighted valuable opportunities to optimize early user engagement, streamline the onboarding flow, and increase conversion from registered to active customers.

Real-Time Engagement Drives 12.89% More KYC Verifications and 59.20% More POS Applications

After identifying the key drop-off points through behavioral analytics, Tami leveraged Dataroid’s real-time data collection and engagement capabilities to detect and respond to user drop-offs as they occurred. Using action-based push notifications triggered by specific drop-off behaviors, the company re-engaged users in a timely and contextually relevant manner, encouraging them to resume the KYC verification or POS application processes.

This real-time, data-driven engagement strategy proved highly effective, resulting in a 12.89% increase in KYC verification completions and a 59.20% increase in POS applications. Through this approach, Tami successfully transformed potential churn points into conversion opportunities, significantly enhancing its rate of operational, active customers.

Key results

59.20%

increase in POS application completion rates

12.89%

increase in KYC verification completion rates

59%

increase in same-day POS applications by new users via action-based push notifications

80%

increase in POS applications by new users two days after account creation and registration

Drive your digital growth

Schedule a demo today to learn more on how we can help you unleash the potential of digital using Dataroid.